Market Volatility…It’s Back

By Ryan Turbyfill, MBA

Volatility is something most of us try to avoid in our lives. None of us enjoy periods of discomfort and uncertainty, and when our money is involved, it’s easy to react on impulse. Volatile markets come with the territory but it’s always good to be prepared and proactive.

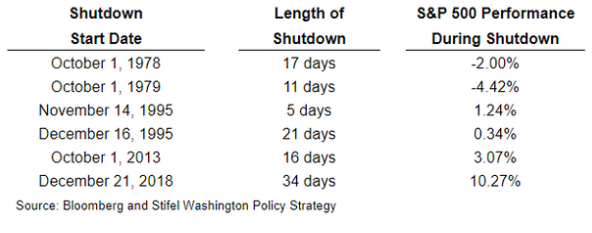

The big news story of late is the pending government shutdown. We have little

confidence that Congress will reach a resolution to avoid a shutdown by October 1. So why don’t we sell all stocks to weather the storm? Well, below is an illuminating chart showing how the S&P500 Index performed during previous government shutdowns.

Not too bad, right? Who knows how the market will react if the government does in fact shut down and with the recent pullback in the market, how much is already priced in? It often happens that by the time the “dust settles” the market has already rallied back. Timing the

market is something no one has mastered, including us. Now if data, both on corporate earnings, economic data, etc. leads us to believe we are in for a rough patch, we will reduce exposure to the markets.

The good news is that while the Federal Reserve may raise rates one more time before the end of 2023, we believe much of that is priced in and rates have or are close to plateauing. Not

only does that help the bond market which had the worst year on record in 2022, but the stock market as well as the cost of debt for both companies and consumers flattens or decreases.

One thing to remember is that we craft portfolios based on a client’s risk tolerance and time horizon. If a client takes out funds periodically or is planning to in the future, we put a portion of cash or cash

equivalents in money market funds, CDs or Treasury bills. For clients with a moderate time frame, we build in higher yielding (higher interest paying) holdings such as preferred stocks, etc. And for folks with long range plans, we invest in the traditional stock market.

An investor when they buy a stock, they become a part owner in the company. This is why we look for companies with

great management teams, increasing revenue and earnings over the long term, manageable debt and products that have a barrier or “moat” for competition. I admit that over the years their stock prices have bounced around quite a bit but in the long run the stock market has grown nicely.

Our goal is to find companies that meets our criteria for our clients, commit to that company, and enjoy the benefits of growth, solid products, and

management. Now if we feel the price is high, we may not buy more at that time, or if the price dips, we may add to it.

While the weekly ebbs and flows are tough to see, knowing we have the portfolio constructed for your individual needs of each account hopefully mitigates some stress.

Turbulent markets

tend to be a good time to talk to your investment professional. As we navigate the rest of what 2023, please feel free to reach out to me or your advisor, see if your risk level is aligned with your long-term goals and how it matches your financial plan and custom Financial Fingerprint.

Thank you again for your trust in us and we value you as our clients.

*SP

500 Index can’t be directly invested in

*Future performance is not guaranteed, and this is not a solicitation for any stock in particular.